Understanding State Refund California: A Comprehensive Guide

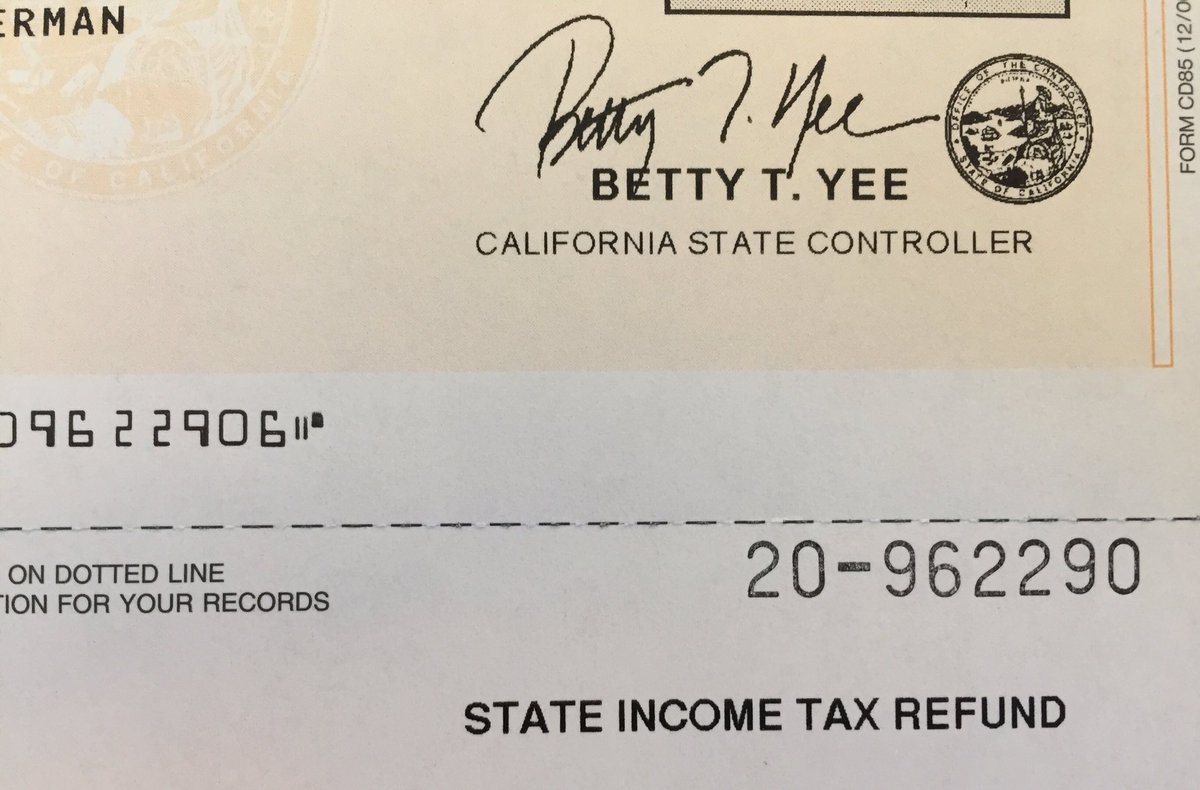

State refund California is a critical financial resource for residents of the Golden State, offering reimbursements for various taxes and fees paid throughout the year. Whether you're a taxpayer looking to maximize your returns or someone seeking clarity on the refund process, this article will serve as your ultimate guide. From understanding the basics to exploring advanced strategies, we'll cover everything you need to know.

As one of the largest economies in the world, California has a complex tax system that can be both beneficial and confusing for its residents. The state refund process ensures that taxpayers are not overburdened by unnecessary payments and helps them reclaim funds they are entitled to. This article will break down the steps and nuances of obtaining a state refund in California, ensuring you are well-informed and prepared.

Whether you're a first-time filer or a seasoned taxpayer, staying updated on the latest regulations and procedures is essential. With the ever-changing landscape of tax laws, having a clear understanding of how refunds work in California can save you time and money. Let’s dive deeper into this topic and uncover the secrets to maximizing your state refund.

- How Many Seasons Are In How I Met Your Mother

- Who Does Joey The Bachelor Choose

- Michael Jordan Disapproves Of Larsa Pippen

- Obama And Jennifer Aniston

- Capricorn Man Obsessed With Scorpio Woman

Table of Contents

- Biography of State Refund California

- What is State Refund California?

- Eligibility Criteria for State Refund

- Types of Refunds in California

- Application Process for State Refunds

- California Tax Laws and Regulations

- Federal vs. State Refunds

- Common Issues with Refunds

- Tips to Maximize Your State Refund

- Future Trends in State Refunds

Biography of State Refund California

Before delving into the specifics of state refund California, it's essential to understand the broader context of how this system came into existence. California has a long history of implementing progressive tax policies designed to benefit its residents. Below is a summary of key milestones and details:

| Category | Details |

|---|---|

| Establishment | State refund programs were first introduced in the early 20th century as part of broader tax reforms. |

| Objective | To ensure taxpayers receive reimbursements for overpaid taxes and fees. |

| Authorities | Governed by the California Franchise Tax Board (FTB) and the State Board of Equalization. |

| Impact | Millions of Californians benefit annually from state refunds, contributing to economic stability. |

What is State Refund California?

State refund California refers to the process by which residents of the state can reclaim funds they have overpaid in taxes or fees. These refunds are typically issued after filing annual tax returns and are calculated based on the difference between the amount paid and the actual tax liability. Some common scenarios where refunds occur include:

- Overpayment of income tax due to incorrect withholding.

- Reimbursement for sales tax on specific purchases.

- Refunds for property tax assessments that were too high.

Understanding the intricacies of this process is crucial for ensuring that you receive all the funds you are entitled to.

- Phil Collins Youll Be In My Heart

- What Happened To The Stars Of Laguna Beach

- Iron Man As Doom

- Where Is Chase Stokes From

- Hold On I Still Want You

Eligibility Criteria for State Refund

Income Tax Refunds

To qualify for a state refund in California, taxpayers must meet certain eligibility criteria. Below are the primary requirements:

- Filing a complete and accurate tax return with the FTB.

- Providing proof of residency in California during the tax year.

- Ensuring all necessary documentation is submitted within the deadline.

According to the FTB, over 80% of taxpayers who file correctly receive their refunds within 21 days. This statistic underscores the importance of adhering to the guidelines set forth by the state.

Types of Refunds in California

Sales Tax Refunds

California offers various types of refunds to cater to different taxpayer needs. Some of the most common include:

- Income Tax Refunds: The most prevalent type, issued to individuals who overpaid on their income taxes.

- Sales Tax Refunds: Available for certain purchases, such as those made by non-residents or for specific exempt items.

- Property Tax Refunds: Issued when property assessments are found to be incorrect or excessive.

Each type of refund has its own set of rules and procedures, making it important to understand which applies to your situation.

Application Process for State Refunds

Steps to File for a Refund

Filing for a state refund in California involves several key steps. Here’s a breakdown of the process:

- Collect all necessary documents, including W-2 forms, 1099s, and receipts for relevant purchases.

- Complete Form 540 or the applicable form for your situation.

- Submit the completed form along with supporting documentation to the FTB.

- Monitor the status of your refund through the FTB’s online portal or via mail.

For those who prefer digital solutions, e-filing is also an option and often results in faster processing times.

California Tax Laws and Regulations

Key Provisions Affecting Refunds

California’s tax laws are constantly evolving, with new provisions being added regularly. Some of the most impactful laws affecting state refunds include:

- Proposition 13: Limits property tax increases, potentially leading to refunds for over-assessed properties.

- Exemption Rules: Provides exemptions for certain groups, such as seniors and low-income individuals.

- Withholding Regulations: Dictates how much employers must withhold from employee paychecks for state taxes.

Staying informed about these laws can help you optimize your refund potential.

Federal vs. State Refunds

Comparing the Two Systems

While both federal and state refunds aim to reimburse taxpayers for overpaid taxes, there are significant differences between the two systems. Below are some key distinctions:

- Filing Deadlines: Federal and state deadlines may differ, so it's important to check both.

- Tax Rates: California has higher income tax rates compared to the federal government, affecting refund amounts.

- Exemptions: State exemptions often vary from federal ones, impacting eligibility.

Understanding these differences can help you navigate both systems more effectively.

Common Issues with Refunds

Delays and Denials

Despite the efficiency of the state refund system, issues can arise. Some common problems include:

- Processing Delays: Caused by incomplete or incorrect filings.

- Denials: Resulting from non-compliance with tax laws or missing documentation.

- Fraud: Identity theft and fraudulent claims can lead to complications.

To avoid these issues, ensure that all information provided is accurate and up-to-date.

Tips to Maximize Your State Refund

Strategies for Greater Returns

Maximizing your state refund requires careful planning and attention to detail. Consider the following tips:

- Claim all eligible deductions and credits.

- Review your withholding amounts regularly to avoid overpayment.

- Consult with a tax professional for personalized advice.

Implementing these strategies can significantly increase the size of your refund.

Future Trends in State Refunds

Technological Advancements

As technology continues to advance, the future of state refunds in California looks promising. Innovations such as:

- Artificial intelligence-driven processing systems.

- Enhanced cybersecurity measures to protect taxpayer information.

- Expanded e-filing options for greater accessibility.

These developments are expected to streamline the refund process, making it faster and more secure for all residents.

Conclusion

In conclusion, understanding state refund California is vital for anyone looking to optimize their financial situation. By following the guidelines outlined in this article, you can ensure that you receive all the funds you are entitled to. Remember to:

- Stay informed about the latest tax laws and regulations.

- File your taxes accurately and on time.

- Explore all available deductions and credits.

We encourage you to share this article with others who may benefit from it and to leave any questions or comments below. Together, we can make the most of the state refund system in California.

Article Recommendations

- Iron Man As Doom

- Megan Fox Kids Transitioning

- Son Kat Von D

- Taurus And Aries In Bed

- Jujutsu Kaisen Garlic Sauce

Detail Author:

- Name : Fermin Kuhn

- Username : kamryn.leffler

- Email : luella.yost@yahoo.com

- Birthdate : 1991-12-16

- Address : 68874 Robert Forges East Johann, IN 41718

- Phone : +1-248-319-0606

- Company : Kulas, Harris and Hirthe

- Job : Forming Machine Operator

- Bio : Dolorum earum et omnis tempora asperiores nihil nesciunt. Sunt omnis dolores qui omnis modi at. Ipsa eos unde corporis.

Socials

tiktok:

- url : https://tiktok.com/@audie_gleichner

- username : audie_gleichner

- bio : Quos eum magni impedit sit quae explicabo suscipit.

- followers : 6260

- following : 1298

facebook:

- url : https://facebook.com/audie6306

- username : audie6306

- bio : Delectus placeat expedita ad ut. Est voluptatem in nihil doloribus mollitia.

- followers : 4755

- following : 490

twitter:

- url : https://twitter.com/audie.gleichner

- username : audie.gleichner

- bio : Enim id mollitia nihil sit voluptatibus. Unde ullam dolor non nam qui.

- followers : 218

- following : 2817

instagram:

- url : https://instagram.com/audie.gleichner

- username : audie.gleichner

- bio : Eos quisquam neque ut ipsa ab. Soluta ab illum aperiam quasi cumque delectus quia ut.

- followers : 4969

- following : 2344